Market Report

Learn more about all important trends in the precious metals markets in our market reports on a regular basis.

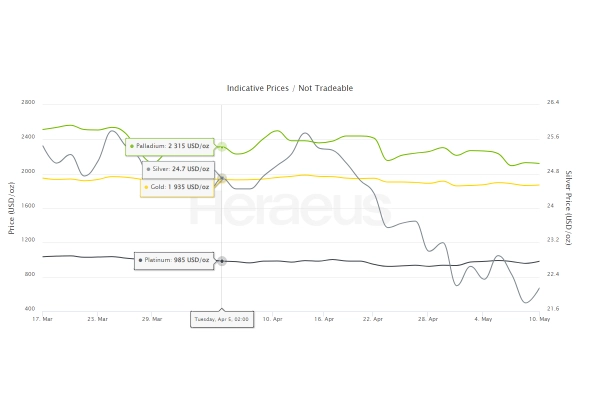

Has platinum started a new bull market?

No. 25 | 14th July 2025

Half-way through this decade, the platinum price has largely gone sideways,

underperforming many other assets. Including the recent price rally,

platinum has returned 26% since January 2020. The US stock market, on

the other hand, has returned 91% since then, and gold 119%.

Register for our Market Report

You would like to receive our market report by e-mail? Then register now using the form provided below.

After submitting the form, you will receive an activation link via e-mail. Please confirm your registration by clicking on the link. You can, of course, withdraw this consent at any time. At the end of each newsletter you will find a corresponding unsubscribe link.